Trend strategies can be classified into several groups. For example, trading on the breakdown of levels or long-term strategies. Swing trading is trend trading that allows you to catch local corrections and open trades at their bottom at the best price.

It is considered one of the best trading models for novice traders, since with a moderate income in a short period, the trend is relatively accurately predicted, that is, the risk is minimal.

What is Swing Trading?

Any market has two main states: a directional, pronounced movement up or down (the so-called trend movement) and a flat – a lateral price movement. Counter-trend strategies involve opening trades before a potential price reversal, but “the trend is a trader’s friend” and counter-trend tactics are the way to quickly lose your deposit.

Swing trading is one of the types of trend tactics that involves opening trades in the direction of price movement at the bottom of local rollbacks. This trading model is interesting in that with strict adherence to risk management rules, the number of losing trades in relation to profitable ones is relatively small, and the strategy itself is understandable even to a novice trader.

Swing trading is the general name for a trading model that involves the use of rollback (correction) moments at the time of trend formation.

A bit of history

This technique was described in detail in the middle of the last century in the book “The Taylor Trading Technique” by J. Douglas Taylor. He considered the wave movement of the market, highlighting the daily cycles on it and breaking them into separate sections. Later, his ideas were developed by other traders. The name of the model comes from the English “swing” – swing, turn, swing.

The essence of the swing trading model

The essence of the swing trading model is as follows. If there is a pronounced directional price movement in the market, then logic dictates that it should be used.

But where is the guarantee that at this moment the trend will not reverse and the attempt to “jump into the last car” will be unsuccessful? Swing trading involves opening a trade at the time of a trend correction.

For example, on an uptrend, the price rolled back a little and at some level turned back in the direction of the main movement. At this moment, it is obvious that the price will at least return to the previous level (it is important to distinguish a correction from a reversal).

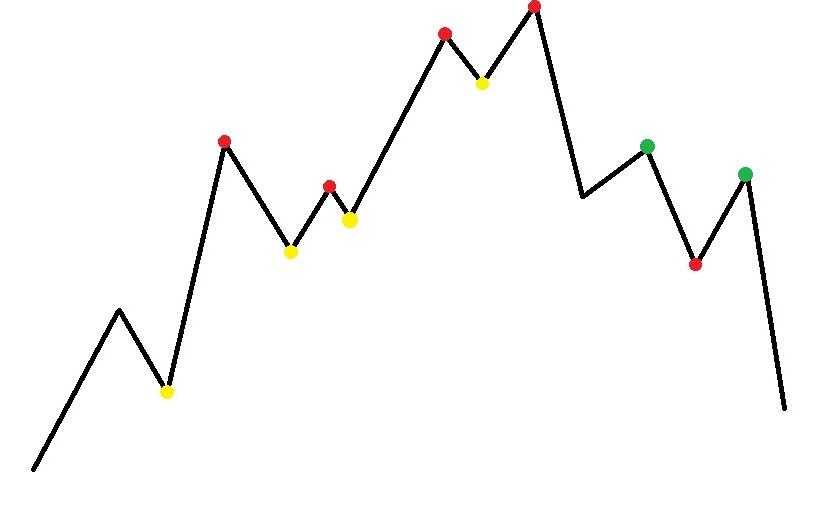

Schematically, it looks like this:

LiteFinance: Swing Trading: Strategies, Indicators and Signals for Forex Trading – LiteFinance

We are looking for the beginning of a trend, waiting for a rollback.

At the bottom of the first rollback, we open a long position (yellow dots) with the expectation that at the moment the trend continues, the price will reach at least the previous high.

We close the deal at the moment of the first clear hint of a reversal (I will talk about tools that allow you to find reversals below). And so we do throughout the growing trend.

After the peak, we see a clear long downward segment – we do not open a deal. We are waiting for the next reversal, we see that the growing trend is weak, which means that a downward movement has begun, on an upward correction (green dot) we open a deal.

Benefits of swing trading:

Versatility and frequent market entry signals. Swing trading involves opening deals on corrections in any direction. A trader earns on short-term movements by opening trades at the extreme of a correction, so the direction of the trend is not important for a trader, it is important to distinguish a correction from a change in the direction of price movement.

Fast result of transactions. Swing trading – short-term trading, the effectiveness of the trading strategy is visible in a few hours. It is also a plus from a psychological point of view. If a trader sees an error after a few minutes, he quickly closes the losing trade and changes the direction of the position.

No swap costs. Swap – a fee for transferring open trades to the next day.

Disadvantages of swing trading:

Relatively low profitability in points of one transaction. A swing trader enters the market on pullbacks at the best price and closes the trade at the next reversal. One movement averages 5-15 points depending on the timeframe, while on intraday strategies you can take income within the average volatility – more than 20 points. Less profitability of the transaction is only for scalping.

The need for a deep understanding of market behavior, constant monitoring of the news. The reasons for local corrections may be fundamental factors or the influence of institutional investors, market makers. The trader must understand the nature of the current movement. Therefore, he must follow the news and have a certain amount of intuition and flexibility in order to quickly turn the situation in his favor.

Psychological load. The trader must identify the trend, constantly look for the best entry points and close trades on time. The constant presence at the computer causes fatigue, dispersion of attention and emotional stress.

Swing trading patterns

1. “Hammer” and “Inverted Hammer” with a pin bar. This pattern marks the end of the correction. A downward correction ends with a pin bar – a candlestick with a short body and a long downward shadow. A pin bar means that the “bears” on the current time period tried to “push” the price down, but by the end of the period the price almost returned to its previous level – the forces of the “bears” were not enough. Strengthening signal – on a downward correction, the pin bar has a green candlestick body, on an upward correction, it is red.

The presence of a long shadow is not always necessary. If each subsequent candle has a smaller body, this indicates that the correction is fading. And at the next reversal, you can open a deal in the direction of the main trend.

Example:

LiteFinance: Swing Trading: Strategies, Indicators and Signals for Forex Trading – LiteFinance

The screenshot shows that in a downtrend, all corrections ended with a candlestick with a relatively small body and a relatively long shadow. You should not navigate by patterns alone, add indicators, draw strong resistance and support levels on the chart.

2. Swing Failure Pattern. This figure is called the most significant in swing trading, as it works almost always. The only problem is to see it – it is rare in its pure form. The idea of the pattern was formulated by Thomas Dante, who called this candlestick pattern “false breakdown of the High or Low of the previous swing”.

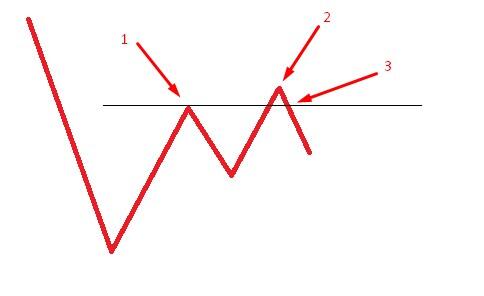

Schematically, the pattern looks like this:

LiteFinance: Swing Trading: Strategies, Indicators and Signals for Forex Trading – LiteFinance

There is a major downtrend on which a correction is formed. Point “1” is called a swing high – this is the upper extremum of the correction, after which short positions are opened in anticipation of a continuation of the downtrend. At the same level are set:

Stop-loss orders for short positions in case the price turns around and goes up.

Pending Buy-Stop orders for those who bet on the upward movement of the chart.

Large players are interested in total liquidity. Their task is to enter the market once with a large volume so as not to affect the value of the asset. Understanding where the accumulation of orders is and seeing the Depth of Market, they wait for the next swing high, which breaks through the previous resistance level and open a mirror trade. At point “2”, stop-losses on short positions have already been triggered, orders to buy “bulls” on pending Buy-Stop orders have been satisfied, nothing prevents market makers from pushing the price further in the direction of a downtrend with a large volume. At point “3” a short position is opened on the pattern.